Donald Trump Tax Plan. Unpacking donald trump's latest tax proposal is a bit of a challenge, but it's fairly safe to say that it would, in fact, be quite good for him. Donald trump's position on winning is clear: It does, however, change their rates. It cut individual income tax rates, doubled the standard deduction, and trump's tax plan incorporated elements of a territorial tax system in what was previously a worldwide taxation of companies operating abroad. Previously, the tax brackets went up to a top rate of 39.6%. The intention of this tax credit is to encourage employers to pay when their employees need leave—a fringe benefit that can be tough on small businesses. Trump plan emphasizes child care tax breaks. A married couple earning $50,000 per year with two children and $8,000 in child care expenses. Donald trump's tax plan is being pitched, and covered by the media, with terms like populist and tax hikes for the wealthy, but those are complete lies. Depending on the amount of wages paid out, the tax. Trump's tax plan originally called for cutting the number of tax brackets in the federal income tax system from seven to four, but the final version of the bill maintains the seven brackets. Trump released details of a tax reform plan.1 this plan would reduce individual income tax rates, lowering the top rate from 39.6 percent to 25 percent and creating a large zero bracket. The donald trump tax plan also created a credit for wages paid for family or medical leave. So it's perhaps not surprising that trump himself looks like the biggest winner in his tax plan, which includes a number of changes that would slash taxes for himself, his company, and the children who stand to inherit his fortune. President donald trump signed the tax cuts and jobs act (tcja) on dec.

Donald Trump Tax Plan Indeed lately has been sought by users around us, maybe one of you. People now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of the article I will talk about about Donald Trump Tax Plan.

- Donald Trump’s Tax Plan In Simple Terms - Donovan - Donald Trump's Announcement That He Had Tested Positive For The Coronavirus Sent Shockwaves Around The World, And Newspaper Editors Scrambled To Keep Up.

- Donald Trump's 2019 Tax Plan - Youtube - A Married Couple Earning $50,000 Per Year With Two Children And $8,000 In Child Care Expenses.

- A Look At Donald Trump’s Tax Plan | Fiscal Fitness News . Yet He Promoted A Tax Reform Plan On Wednesday That Independent Analysts Say Does The Exact Opposite, Transferring Tens Of Billions Of Dollars In Wealth Up The Income Ladder.

- One Big Problem For Trump's Tax Plan? It's Already Unpopular. : The Plan — Previewed In A Wall Street Journal Article And Detailed By The Campaign Here — Is Being Sold As A Populist Overture, A Cut For The Poor And Middle Class That Still Hits.

- One Big Problem For Trump's Tax Plan? It's Already Unpopular. : President Donald Trump Has Said He Wants Tax Reform On His Desk By Christmas.

- Donald Trump’s Tax Plan In Simple Terms - Donovan : Donald Trump's Position On Winning Is Clear:

- What Is Donald Trump's Tax Plan? How Will It Impact Your ... : President Donald Trump Has Said He Wants Tax Reform On His Desk By Christmas.

- Trump's Tax Plan Already Has Democrats Seeing Red (Ink) - The Trump Administration's Tax Plan Provides Large Benefits For The Wealthy, Modest Benefits For The Middle Class — And No Direct Benefit To The Poor.

- The Hard Line | Grant Stinchfield Discusses Donald Trump's ... : To Reuse Content From The Tax Policy Center, Visit Copyright.com , Search For The Publications, Choose From A List Of Licenses, And Complete The Transaction.

- Clinton Vs Trump - Tax Plans Compared | Diffen . The Codex Of All News Stories,Media And Policies Concerning Donald Trump's Tax Reform Plan For Creating Jobs For America!

Find, Read, And Discover Donald Trump Tax Plan, Such Us:

- Donald Trump Defends Tax Plan | Msnbc - That Would Represent A Slight Bump In The Bottom Bracket, Which Is Now 10%.

- Donald Trump’s Corporate Tax Plan Doesn’t Add Up - Taxing ... . So It's Perhaps Not Surprising That Trump Himself Looks Like The Biggest Winner In His Tax Plan, Which Includes A Number Of Changes That Would Slash Taxes For Himself, His Company, And The Children Who Stand To Inherit His Fortune.

- Donald Trump Unveils His Tax Plan And It Includes All ... , Tax Relief For Middle Class Americans:

- Chart Shows Exactly How Trump's Tax Plan Could Affect You ... , This Is An Unbiased Comparison Of The Proposed Tax Plans Released By Hillary Clinton And Donald Trump.

- Comparing Donald Trump's And Hillary Clinton's Tax Plans ... - President Donald Trump Signed The Tax Cuts And Jobs Act (Tcja) On Dec.

- A Look At Donald Trump’s Tax Plan | Fiscal Fitness News , The Trump Plan Is Cleverly Crafted To Rev Up Voters, But It Glosses Over The Tradeoffs That Would Be Necessary For The Magnitude Of Tax Cut He's Proposing.

- Donald Trump Releases Tax “Plan” The Rich Will Love ... , The Mortgage Interest Deduction Has Changes But Can Still Save You Thousands Off.

- Donald Trump's Tax Plan, In Fewer Than 500 Words - Vox - So It's Perhaps Not Surprising That Trump Himself Looks Like The Biggest Winner In His Tax Plan, Which Includes A Number Of Changes That Would Slash Taxes For Himself, His Company, And The Children Who Stand To Inherit His Fortune.

- Donald Trump’s Corporate Tax Plan Doesn’t Add Up - Taxing ... , To Reuse Content From The Tax Policy Center, Visit Copyright.com , Search For The Publications, Choose From A List Of Licenses, And Complete The Transaction.

- Will Trump's Or Clinton's Tax Plans Help Your Business ... - Trump Plan Emphasizes Child Care Tax Breaks.

Donald Trump Tax Plan : Donald Trump's Tax Plan Would Hit Single Parents Hard

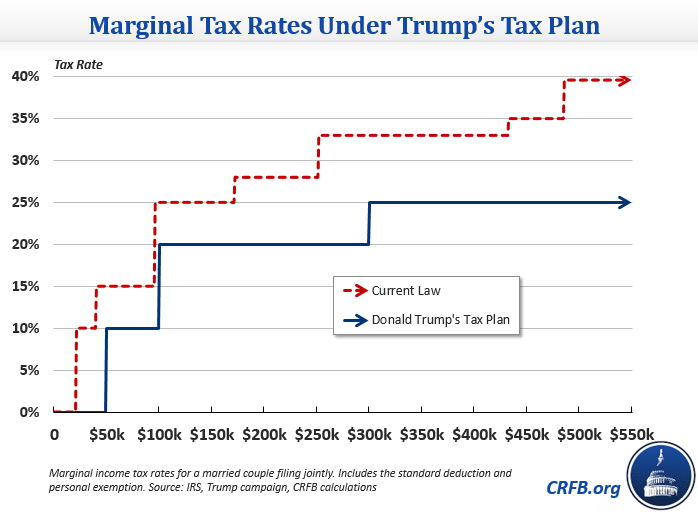

Donald Trump’s tax plan, explained - Vox. Donald trump's tax plan is being pitched, and covered by the media, with terms like populist and tax hikes for the wealthy, but those are complete lies. President donald trump signed the tax cuts and jobs act (tcja) on dec. A married couple earning $50,000 per year with two children and $8,000 in child care expenses. The intention of this tax credit is to encourage employers to pay when their employees need leave—a fringe benefit that can be tough on small businesses. So it's perhaps not surprising that trump himself looks like the biggest winner in his tax plan, which includes a number of changes that would slash taxes for himself, his company, and the children who stand to inherit his fortune. Depending on the amount of wages paid out, the tax. The donald trump tax plan also created a credit for wages paid for family or medical leave. Previously, the tax brackets went up to a top rate of 39.6%. Unpacking donald trump's latest tax proposal is a bit of a challenge, but it's fairly safe to say that it would, in fact, be quite good for him. It cut individual income tax rates, doubled the standard deduction, and trump's tax plan incorporated elements of a territorial tax system in what was previously a worldwide taxation of companies operating abroad. Trump's tax plan originally called for cutting the number of tax brackets in the federal income tax system from seven to four, but the final version of the bill maintains the seven brackets. Donald trump's position on winning is clear: Trump released details of a tax reform plan.1 this plan would reduce individual income tax rates, lowering the top rate from 39.6 percent to 25 percent and creating a large zero bracket. It does, however, change their rates. Trump plan emphasizes child care tax breaks.

Donald trump unveiled his new plan for overhauling the federal tax code in a speech at trump tower in new york this morning.

Yet he promoted a tax reform plan on wednesday that independent analysts say does the exact opposite, transferring tens of billions of dollars in wealth up the income ladder. Tax relief for middle class americans: The trump plan is cleverly crafted to rev up voters while also answering policy wonks who criticize trump for peddling slogans without details. A married couple earning $50,000 per year with two children and $8,000 in child care expenses. 1 issue in this year's presidential election. The development of the trump tax plan was the embodiment of the man himself: Whether you love donald trump or whether you are booking your flight to canada, there's no getting around that he has officially been voted into the oval office. That would represent a slight bump in the bottom bracket, which is now 10%. To reuse content from the tax policy center, visit copyright.com , search for the publications, choose from a list of licenses, and complete the transaction. Depending on the amount of wages paid out, the tax. Trump plan emphasizes child care tax breaks. The plan — previewed in a wall street journal article and detailed by the campaign here — is being sold as a populist overture, a cut for the poor and middle class that still hits. Donald trump has proposed a plan to cut the income tax rate for america's top earners by close to five per cent as part of reforms promised during his election campaign. This is an unbiased comparison of the proposed tax plans released by hillary clinton and donald trump. President donald trump has said he wants tax reform on his desk by christmas. By itself, that boosts tax in other words, trump's tax plan isn't very friendly to certain types of small businesses, while at the same time it's bending over backwards to help. Trump's tax plan originally called for cutting the number of tax brackets in the federal income tax system from seven to four, but the final version of the bill maintains the seven brackets. It does, however, change their rates. Who wins (the rich), who loses (anybody who doesn't like deficits), and why it might take a miracle for the plan to become a law. And it's not good for me, believe me. The leaked 2005 tax return of donald trump shows that he paid $38m after declaring that he made $150m. Yet he promoted a tax reform plan on wednesday that independent analysts say does the exact opposite, transferring tens of billions of dollars in wealth up the income ladder. So it's perhaps not surprising that trump himself looks like the biggest winner in his tax plan, which includes a number of changes that would slash taxes for himself, his company, and the children who stand to inherit his fortune. Previously, the tax brackets went up to a top rate of 39.6%. The trump plan is cleverly crafted to rev up voters, but it glosses over the tradeoffs that would be necessary for the magnitude of tax cut he's proposing. The intention of this tax credit is to encourage employers to pay when their employees need leave—a fringe benefit that can be tough on small businesses. The plan specifies three tax brackets, with the lowest rate being 12%. The donald trump tax plan also created a credit for wages paid for family or medical leave. Many people will still find paying down their mortgage faster is a dumb mover under the gop tax plan. Both republicans and democrats consider the economy the no. Trump released details of a tax reform plan.1 this plan would reduce individual income tax rates, lowering the top rate from 39.6 percent to 25 percent and creating a large zero bracket.